The AI-safe CX platform built for regulated financial operations

Reduce cost-per-contact, strengthen compliance, and automate safely with Kustomer’s Intelligent CX platform.

Built for financial brands where trust, accuracy & compliance matter most

Identify

Identify Risk & CX Bottlenecks Before They Impact Customers

Know what’s happening

Ask natural-language questions like “Why did dispute volume spike?” and get real‑time insights, visualizations, and recommended actions. No exports, analysts, or BI delays.

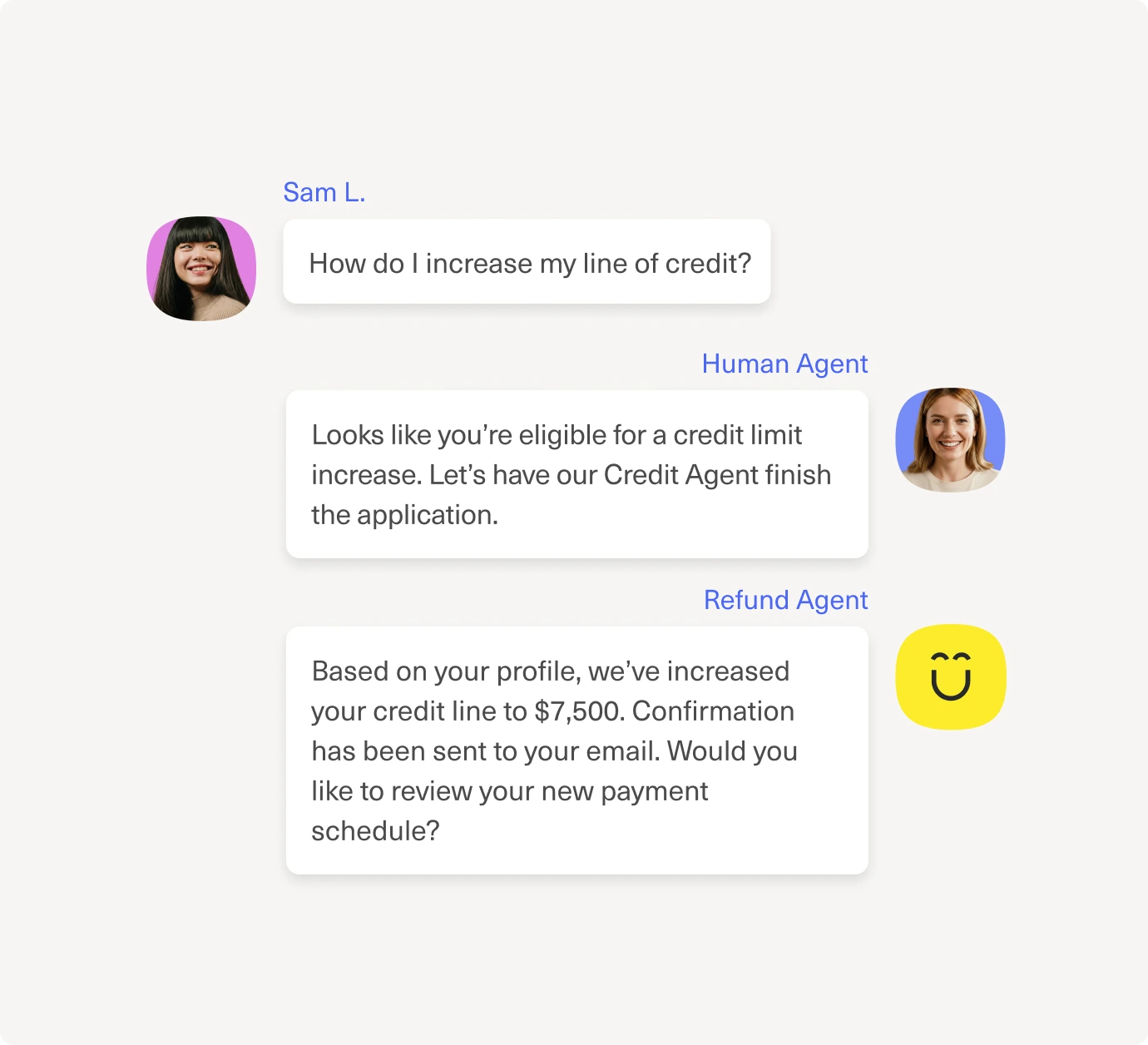

Automate with full financial context

Because Kustomer AI is CRM-native, every action draws from transactions, flags, policies, claims, and identity data, powering higher accuracy and fewer escalations.

Continuously improve

AI learns from every interaction, improving accuracy, tone, and compliance so teams scale automation with confidence.

Why

Why modern financial CX needs AI now

Prepare your data

Auto‑categorization, summaries, and suggested replies across messages, claims, verifications, and transactions.

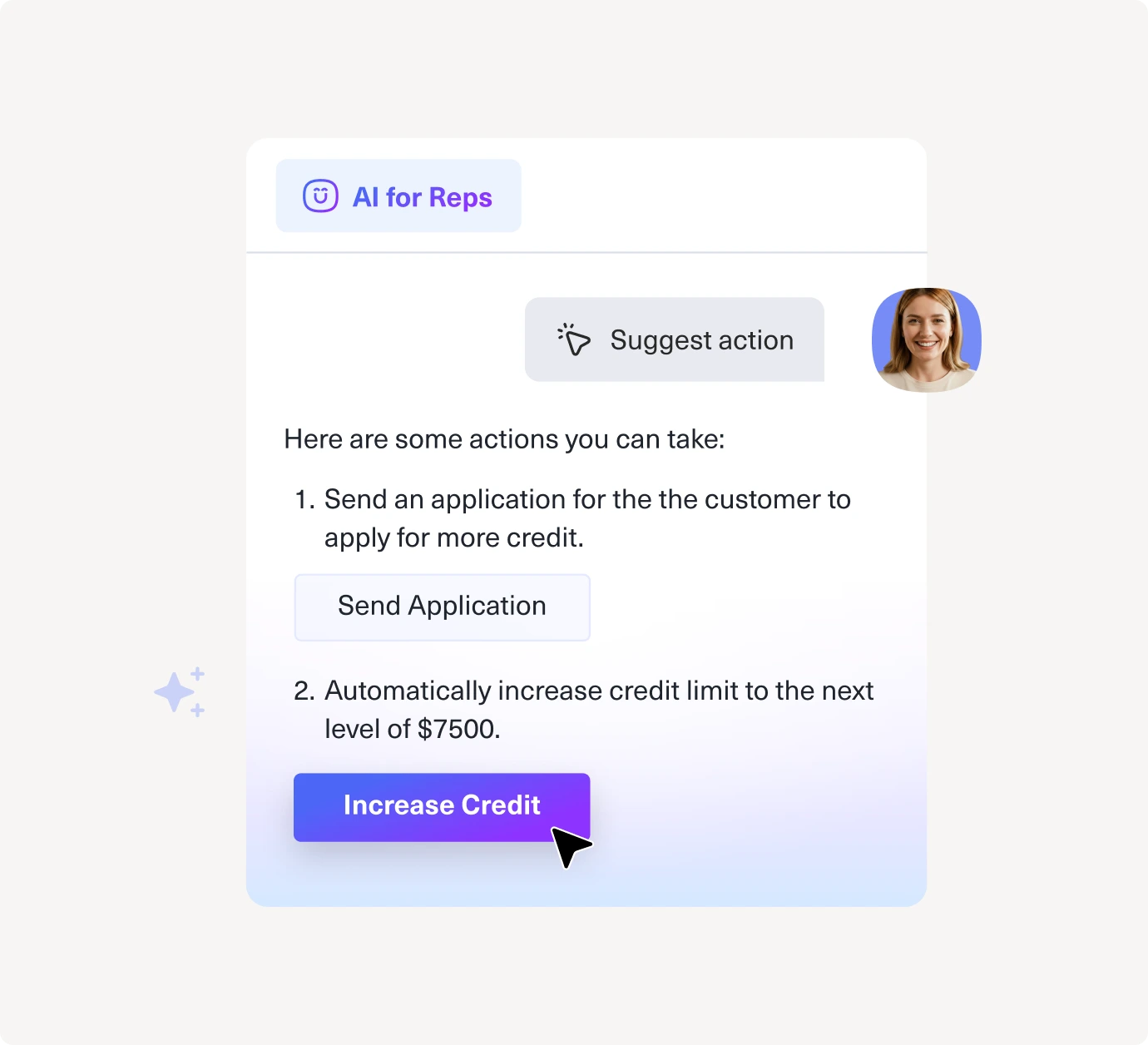

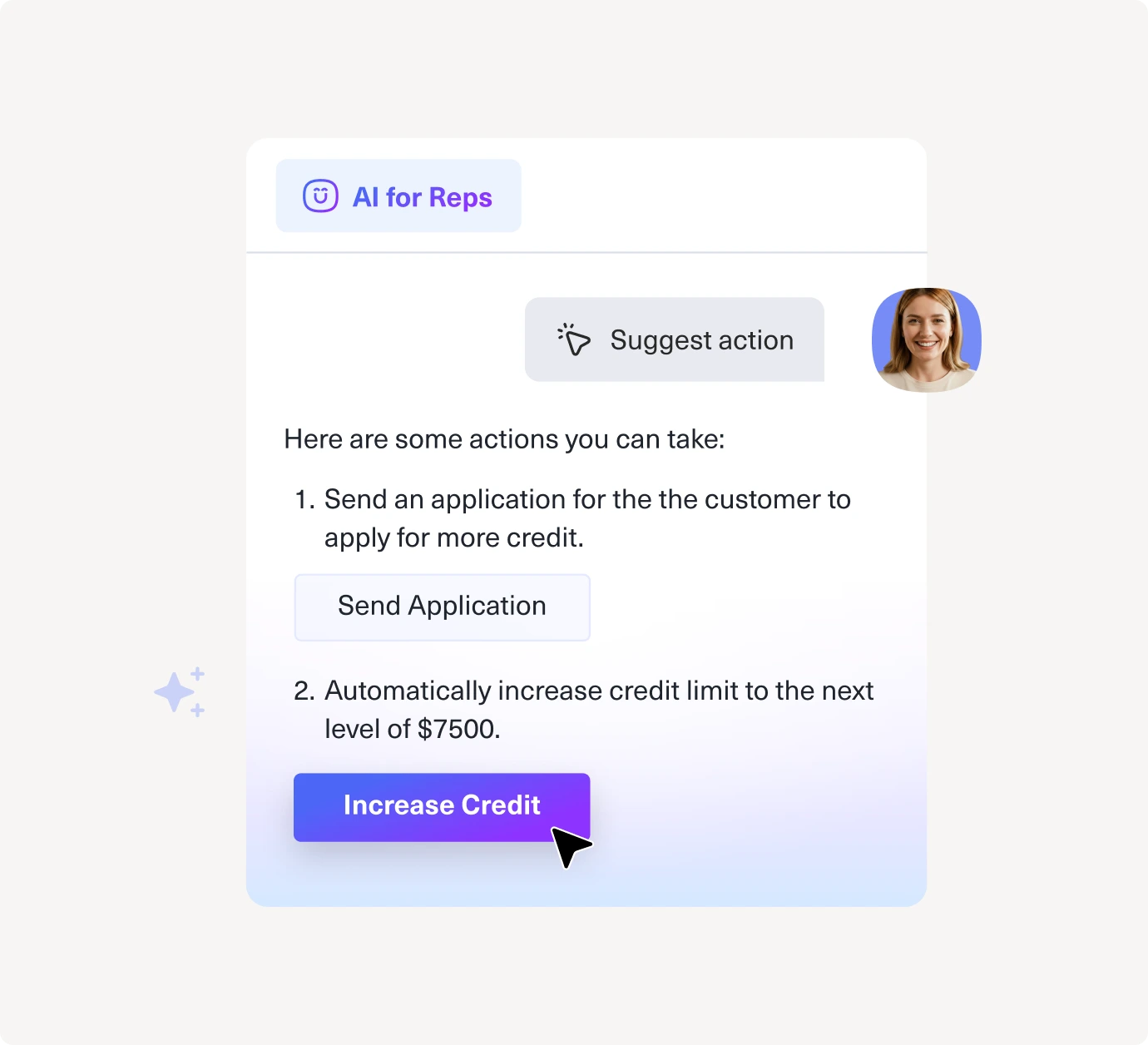

Optimize Your Team

Confidence‑scored answers and workflow actions that prevent fraud, risk, and churn.

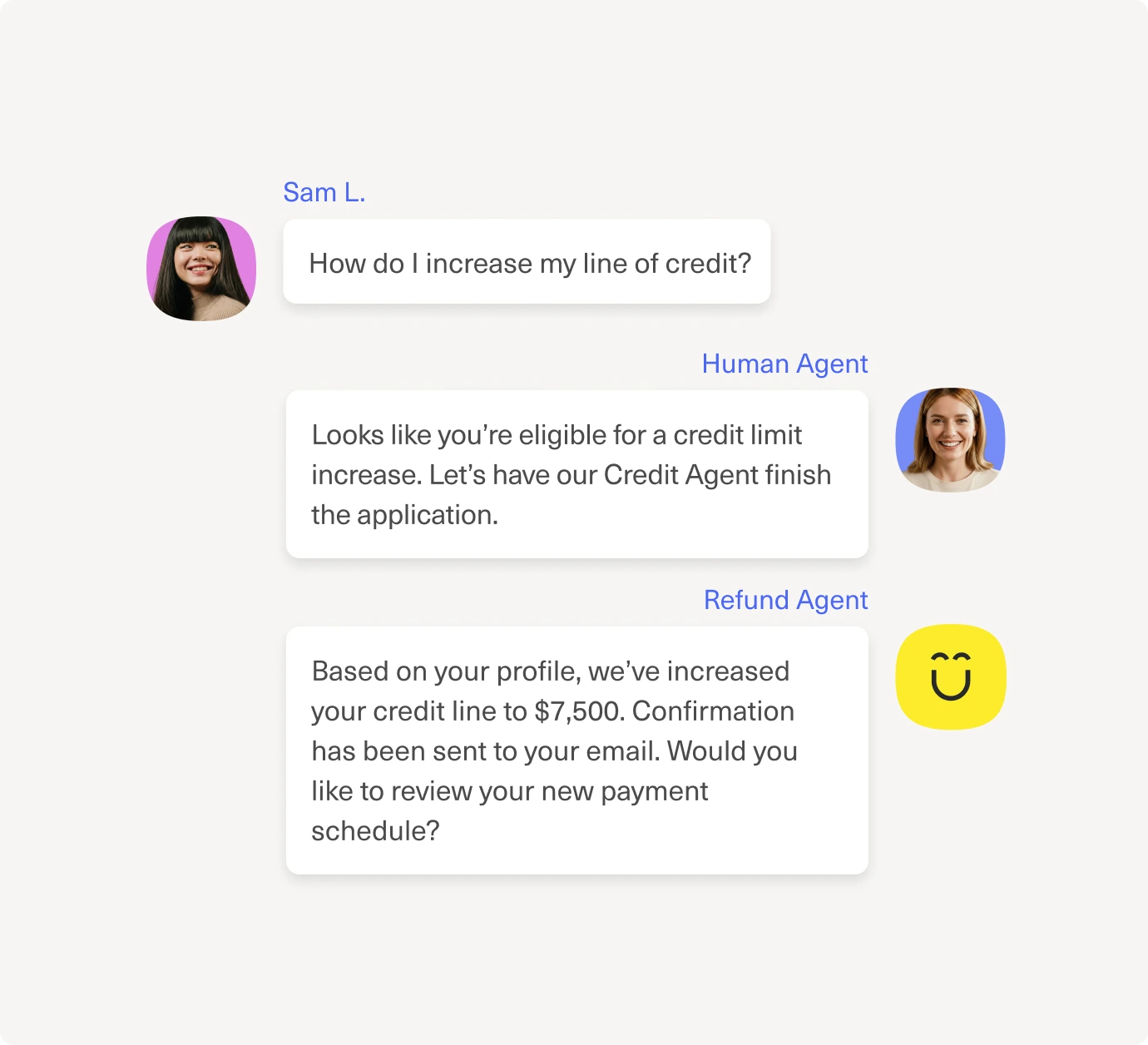

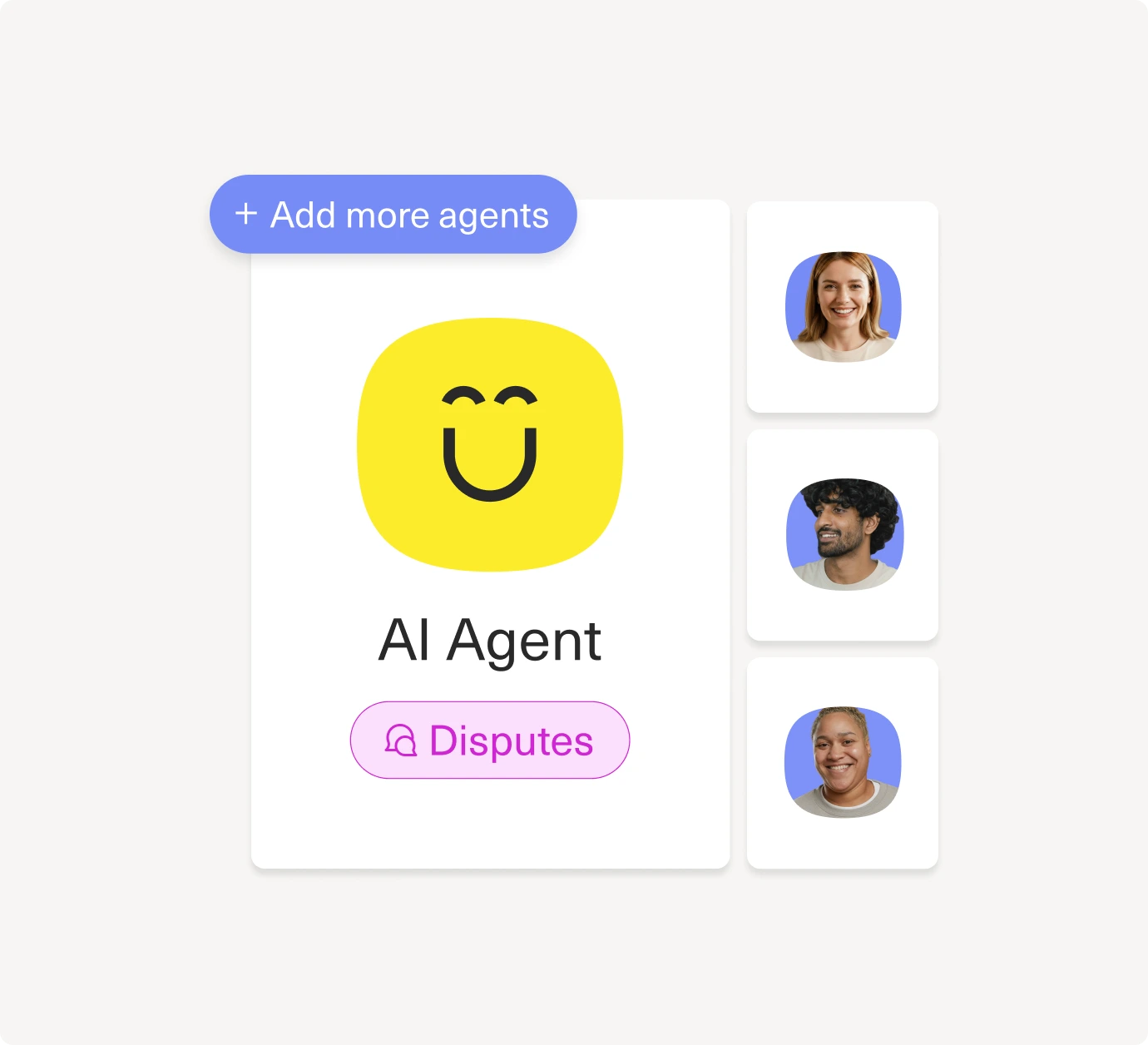

Orchestrate End-to-End with AI

Fully automated triage, KYC workflows, dispute handling, and proactive outreach, no engineering required.

Built

Built for How Finance Teams Actually Work

For CX & Operations

Resolve inquiries 2–3× faster with unified customer context and proactive automation.

For Fraud & Risk

Detect signals instantly with shared timelines, role‑based permissions, and workflow triggers.

For Compliance

Meet audit and regulatory needs with governed access, logs, role-based permissioning, controlled actions, complete traceability, and consistent workflows.

Scale

Scale Seamlessly Through Any Volume Surge

Agents stay ahead

With full customer history, verification status, policy data, and fraud flags.

Automate high-volume workflows

Embodied AI Agents handle end-to-end tasks like: resetting 2FA, explaining claim status, resolving simple disputes, sending proactive policy or account updates.

Route with precision

Ensure KYC reviews, flagged transactions, or complex claims go to the right human, automatically.

Built for financial brands where trust, accuracy & compliance matter most

Why most AI fails in Finance and why Kustomer doesn’t

Others' AI

Kustomer’s AI

For leaders, by leaders

CX leaders need operational clarity, not more dashboards.

Kustomer is purpose‑built to ensure AI is trustworthy, transparent, and tied to real outcomes.

Join top finance brands scaling smarter with Kustomer